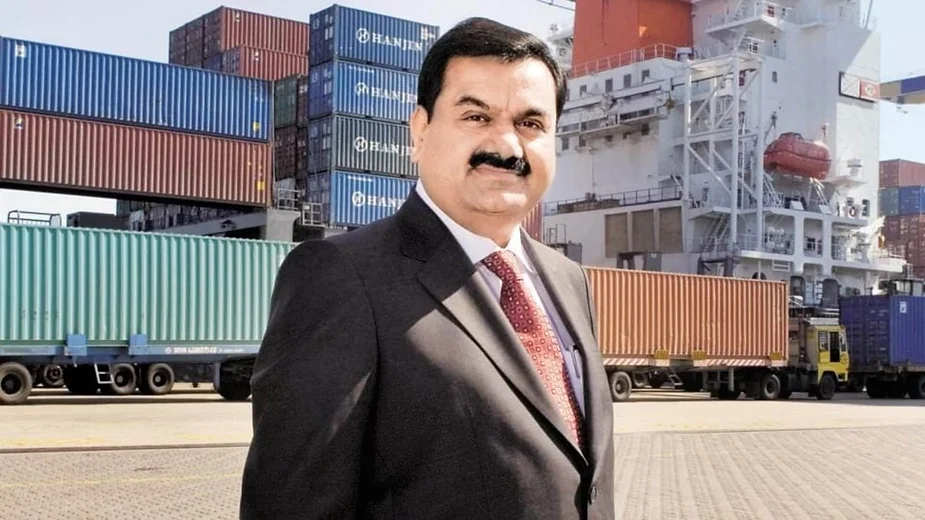

Indian business tycoon Gautam Adani stands strong while becoming a success story in itself for the world by becoming the third richest person in the globe and the first Asian to stand among the top 3 richest people in the world with a net worth of $137.4 Billion.

A motivational story behind the success of Gautam Adani is his hard work, consistency and the attitude to never give up despite hardships. Adani has come a long way from dropping out of college in his second year at Gujarat University to becoming a diamond sorter.

The founder of the Adani Group, which has a massive portfolio of companies in various industries, including ports, coal and energy Gautam Adani made himself count among the billionaires in India in 2008, 20 years after starting his commodities export firm. The 60-year-old passed Bill Gates on the rich list in July after Gates announced he would be giving $20 billion to the Bill & Melinda Gates Foundation.

Ranked No. 3 on the global wealth rankings. Indian billionaire Gautam Adani leapfrogged luxury goods magnate Bernard Arnault on Tuesday. With a $137 billion fortune, according to the Bloomberg Billionaires Index, Adani is the first-ever Asian man to crack the top three. He sits behind only Amazon founder Jeff Bezos (worth $153 billion) and Tesla CEO Elon Musk (worth $251 billion) on the rich list.

Adani has added $60.9 billion to his fortune so far this year, making him the only member of the top 10 to not have his net worth drop in 2022.

Listed Adani group companies are Adani Enterprises, Adani Green Energy, Adani Ports and Special Economic Zone, Adani Power, Adani Total Gas, and Adani Transmission. The Adani group is also said to be the largest coal trader in the country. Revenue of $5.3 billion was reported by Adani Enterprises in the year to March 31 2021.

The Adani Group is the third largest conglomerate (after Reliance Industries and the Tata Group) in India.

Adani has spent the past few years expanding his coal-to-ports conglomerate, venturing into everything from data centers to cement, media and alumina. The group now owns India’s largest private-sector port and airport operator, city-gas distributor and coal miner.

Another act of Adani groups towards the country can be seen through their lookout towards the country's environmental issues. As the group faced criticism towards its Carmichael mine in Australia and was criticized by environmentalists, it pledged in November to invest $70 billion in green energy to become the world’s largest renewable-energy producer.

The pivot to green energy and infrastructure has won investments from firms including Warburg Pincus and Total Energies SE, helping Adani enter the echelons previously dominated by US tech moguls. The surge in coal in recent months has further turbocharged his ascent.

All told, Adani has added $60.9 billion to his fortune in 2022 alone, five times more than anyone else. He first overtook Ambani as the richest Asian in February, became a Centibillionaire in April and surpassed Microsoft Corp.’s Bill Gates as the world’s fourth-richest person last month.

All this has contributed immensely to the success story of the business tycoon over the years. He is indeed an inspiration for everyone and proves the sky is the only limit.

Continue Reading...